Supreme Court on Compensatory Nature of Motor Vehicle Tax – 2025 Judgment

Supreme Court on Compensatory Nature of Motor Vehicle Tax – 2025 Judgment

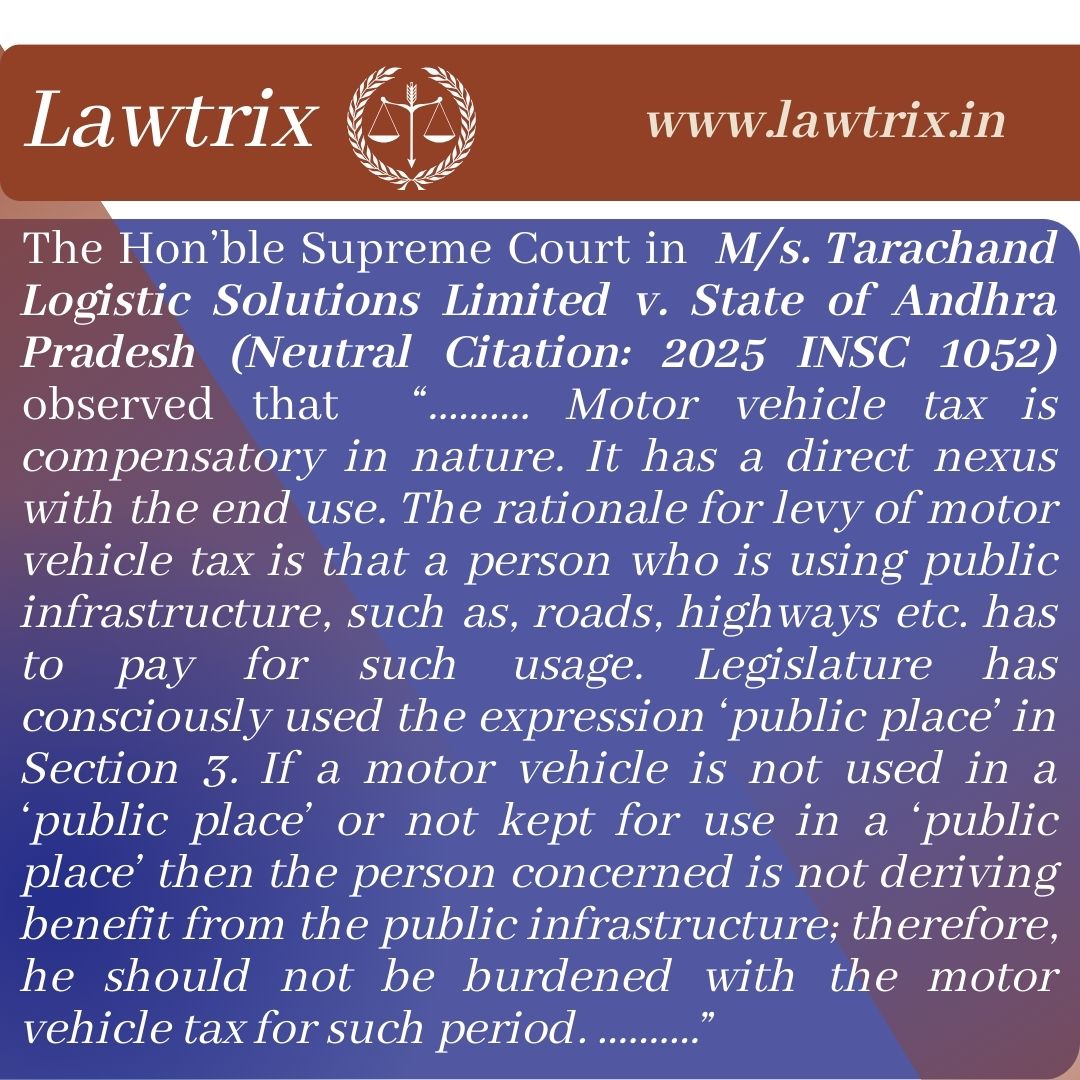

The Hon’ble Supreme Court in M/s. Tarachand Logistic Solutions Limited v. State of Andhra Pradesh (Neutral Citation: 2025 INSC 1052) observed that:

“.......... Motor vehicle tax is compensatory in nature. It has a direct nexus with the end use. The rationale for levy of motor vehicle tax is that a person who is using public infrastructure, such as, roads, highways etc. has to pay for such usage. Legislature has consciously used the expression ‘public place’ in Section 3. If a motor vehicle is not used in a ‘public place’ or not kept for use in a ‘public place’ then the person concerned is not deriving benefit from the public infrastructure; therefore, he should not be burdened with the motor vehicle tax for such period. ..........”

SEO Keywords: Supreme Court motor vehicle tax judgment 2025, Tarachand Logistic Solutions case, compensatory nature of motor vehicle tax India, motor vehicle tax Supreme Court ruling, Section 3 Motor Vehicle Tax Act interpretation, public place meaning motor vehicle tax, 2025 INSC 1052 case summary, Supreme Court observation on road tax, road tax liability India 2025, motor vehicle tax exemption for non-use, infrastructure usage and vehicle tax law India.